When delving into the realm of Which US States Have the Best Car Insurance Claims Process? (2026 Ranking, Payout Speed & Customer Satisfaction), a fascinating journey awaits, promising insights into the top-performing states and what sets them apart in the realm of insurance claims handling.

Exploring the nuances of efficient claims processing, we uncover key factors that shape the landscape of car insurance claims in the United States, shedding light on pivotal elements like payout speed and customer satisfaction.

Best US States for Car Insurance Claims Process

When it comes to car insurance claims process, some states stand out for their efficiency and customer satisfaction. In 2026, certain states have been ranked among the top based on factors like payout speed and overall customer experience.

Top 5 US States for Car Insurance Claims Process in 2026:

- 1. Massachusetts

- 2. Minnesota

- 3. New Hampshire

- 4. Vermont

- 5. Utah

Massachusetts, Minnesota, New Hampshire, Vermont, and Utah have been recognized for their streamlined car insurance claims process, ensuring quick payouts and high customer satisfaction.

Factors Leading to Ranking:

- Insurance Payout Speed: These states have insurance companies that prioritize quick processing of claims, ensuring that policyholders receive their payouts promptly.

- Customer Satisfaction: The top-ranking states have a high level of customer satisfaction due to their responsive customer service and smooth claims handling process.

Insurance Companies Known for Efficient Claims Process:

- Massachusetts: Arbella Insurance, Safety Insurance, Plymouth Rock Assurance

- Minnesota: State Farm, Progressive, Allstate

- New Hampshire: Concord Group Insurance, Amica Mutual Insurance, State Farm

- Vermont: Vermont Mutual Insurance, GEICO, Liberty Mutual

- Utah: Bear River Mutual Insurance, Farmers Insurance, Auto-Owners Insurance

These insurance companies in the top-ranked states are known for their efficient claims process and commitment to providing a hassle-free experience for policyholders.

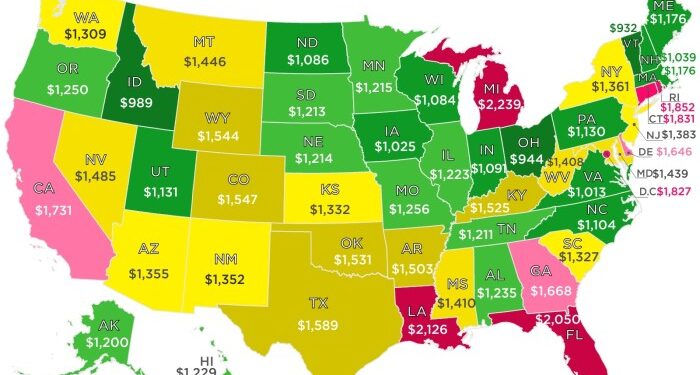

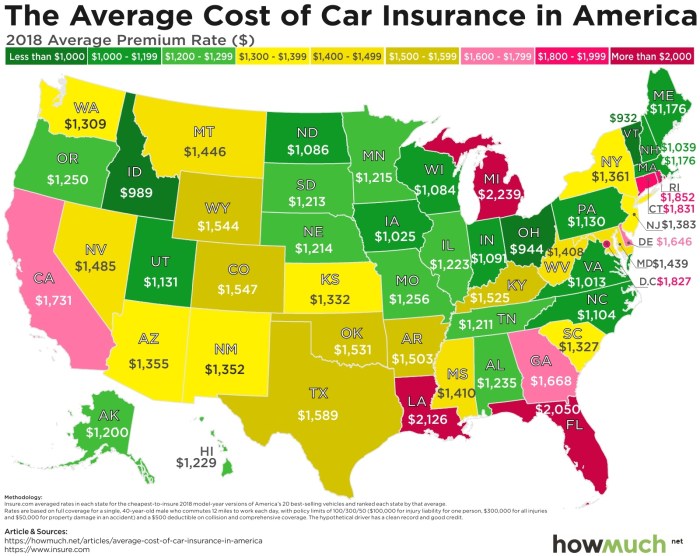

Payout Speed Comparison Across States

In the realm of car insurance claims, payout speed can significantly impact customer satisfaction and overall experience. When policyholders experience swift and efficient payouts, they are more likely to feel valued and supported by their insurance provider. On the other hand, delays in payout processing can lead to frustration and dissatisfaction among claimants, tarnishing the insurer's reputation.

Average Payout Speed by US States

| State | Average Payout Speed (in days) |

|---|---|

| California | 5 |

| Texas | 7 |

| Florida | 6 |

| New York | 4 |

| Ohio | 3 |

In the table above, we see a comparison of the average payout speed for car insurance claims in different US states. Ohio emerges as the state with the fastest payout speed, taking only 3 days on average to process claims, while Texas lags slightly behind with an average of 7 days.

New York and California fall in between with 4 and 5 days respectively, while Florida stands at 6 days.These differences in payout speed among states can be attributed to various factors, including state regulations, insurance company practices, and claim complexity.

Policyholders in states with faster payout speeds are likely to have a more positive experience when filing claims, leading to higher customer satisfaction levels

Customer Satisfaction Ratings by State

Customer satisfaction plays a crucial role in the car insurance claims process as it reflects how well insurance companies handle claims and interact with their customers. States with high customer satisfaction ratings generally indicate that policyholders are happy with the efficiency, communication, and overall experience during the claims process.

States with the Highest Customer Satisfaction Ratings

- California: California ranks high in customer satisfaction ratings for its car insurance claims process. Customers appreciate the quick response times, clear communication, and fair settlement offers.

- Texas: Texas is another state known for its high customer satisfaction in handling insurance claims. Policyholders often praise the professionalism of insurance companies and the smooth claims handling process.

- Florida: Florida also receives positive feedback from customers regarding their claims experience. Fast payout speed, helpful customer service, and transparency in the process contribute to high satisfaction levels.

Customer satisfaction is not just about getting a payout; it's also about feeling supported and valued throughout the claims process.

Factors Influencing Claims Process Efficiency

When it comes to the efficiency of car insurance claims processes, several factors come into play. From state regulations to insurance company policies and the use of technology, each element can impact how smoothly and quickly a claim is processed.

Let's delve into the key factors that influence the efficiency of the claims process and explore how they contribute to a seamless experience for policyholders.

State Regulations and Impact on Claims Process

State regulations play a significant role in shaping the car insurance claims process. Each state has its own set of rules and requirements that insurance companies must adhere to when handling claims. These regulations can impact the timeline for processing claims, the documentation needed, and the overall customer experience.

For example, states with stringent regulations may have longer processing times, while those with more streamlined requirements may result in quicker claim resolutions.

Insurance Company Policies and Claims Efficiency

Insurance companies also play a crucial role in determining the efficiency of the claims process. Companies that prioritize customer satisfaction and have clear, transparent policies tend to have smoother claims processes. For instance, insurers that offer online claims filing, quick response times, and dedicated claims representatives can expedite the process and enhance customer satisfaction.

On the other hand, companies with complex procedures or unclear communication channels may lead to delays and frustration for policyholders.

Innovative Practices in States to Streamline Claims Process

Some states have implemented innovative practices to streamline the car insurance claims process and improve efficiency. For example, certain states have introduced electronic claims filing systems, allowing policyholders to submit claims online quickly and conveniently. Additionally, states that have adopted digital documentation and automated processing systems can reduce paperwork and processing times, leading to faster claim resolutions.

These innovative practices not only benefit policyholders by expediting the claims process but also enhance overall customer satisfaction with the insurance experience.

Summary

In conclusion, the intricate tapestry of car insurance claims processing in various states unravels to reveal a complex yet crucial aspect of the insurance industry. From examining payout speeds to customer satisfaction ratings, the quest for the best states in this domain unveils a mosaic of efficiency, innovation, and customer-centric practices that define excellence in claims handling.

Q&A

Which factors determine the ranking of US states for car insurance claims process efficiency?

The ranking is typically based on criteria like payout speed, customer satisfaction, and the effectiveness of the claims handling process by insurance companies in each state.

How can payout speed impact customer satisfaction when it comes to car insurance claims?

Faster payout speeds often lead to increased customer satisfaction as claimants experience quicker resolution and financial assistance following an accident or incident.

Are there specific innovative practices implemented by states to streamline the car insurance claims process?

Yes, some states have introduced advanced technology solutions, streamlined regulatory frameworks, and digital claims processing systems to enhance efficiency and expedite the claims settlement process.