Delving into Protect Your Practice: Professional Liability vs. Errors & Omissions (E&O) Insurance for Consultants — What You Need in 2026, this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

Professional liability insurance safeguards consultants from risks associated with their services, while Errors & Omissions (E&O) insurance provides protection for negligence claims. Understanding the differences between these two types of insurance is crucial for consultants in 2026.

Understanding Professional Liability Insurance

Professional liability insurance, also known as errors and omissions (E&O) insurance, is designed to protect consultants from legal claims related to professional services they provide. This type of insurance can cover legal fees, settlements, and judgments that may arise from claims of negligence, errors, omissions, or malpractice.

Purpose of Professional Liability Insurance

- Professional liability insurance provides financial protection for consultants in case they are sued by a client for mistakes or failures in their work.

- This insurance helps cover the costs of legal defense, settlements, and damages that may result from a lawsuit.

Examples of Situations Benefiting from Professional Liability Insurance

- Failure to deliver promised results: If a consultant fails to meet the expectations Artikeld in a contract, the client may file a lawsuit for breach of contract.

- Error in professional advice: If a consultant provides incorrect advice that leads to financial losses for the client, they may be sued for negligence.

Coverage and Limitations of Professional Liability Insurance

- Professional liability insurance typically covers legal defense costs, settlements, and judgments up to the policy limit.

- It may also cover claims related to libel, slander, or copyright infringement arising from the consultant's work.

- Limitations of coverage may include exclusions for intentional wrongdoing, criminal acts, or certain types of professional services.

Exploring Errors & Omissions (E&O) Insurance

Errors & Omissions (E&O) insurance is a type of professional liability insurance that specifically protects consultants against claims of inadequate work or negligent actions that result in financial loss for their clients. This insurance is crucial for consultants as it provides coverage for legal costs, settlements, and judgments that may arise from such claims.

Comparison of E&O insurance with professional liability insurance

While both Errors & Omissions (E&O) insurance and professional liability insurance offer protection for consultants, there are key differences between the two. E&O insurance specifically covers claims related to professional negligence, errors, or omissions in services provided, whereas professional liability insurance offers broader coverage for a range of professional services and potential claims.

- E&O insurance focuses on claims of inadequate work or negligent actions.

- Professional liability insurance provides coverage for a wider scope of professional services.

- E&O insurance is more specialized and tailored to the specific risks faced by consultants.

- Professional liability insurance may include coverage for non-professional acts such as bodily injury or property damage.

Real-life scenarios where E&O insurance could have protected a consultant

Consider the following scenarios where Errors & Omissions (E&O) insurance could have been invaluable:

- A management consultant provides advice to a client that results in financial losses for the client due to a miscalculation. E&O insurance could cover the costs of legal defense and any settlements reached.

- A software consultant fails to deliver a project on time, causing significant financial harm to the client. E&O insurance could help mitigate the financial impact of a lawsuit resulting from this oversight.

- An IT consultant accidentally deletes critical data while performing maintenance for a client, leading to costly recovery efforts. E&O insurance could assist in covering the expenses associated with data recovery and any resulting legal claims.

Factors to Consider When Choosing Insurance

When deciding between professional liability and Errors & Omissions (E&O) insurance, consultants need to carefully evaluate their specific needs to ensure they have the right coverage in place

Industry Experience and Expertise

- Assess your level of experience in your field and the specific services you provide as a consultant.

- Consider any specialized expertise or certifications that may impact your insurance needs.

- Consult with industry peers or an insurance professional to gain insights into common risks and coverage requirements for consultants in your field.

- Ensure that the insurance policy you choose aligns with the unique risks associated with your area of expertise.

Client Contracts and Requirements

- Review your client contracts to understand any insurance requirements or limitations they may impose.

- Ensure that your insurance policy meets or exceeds the minimum coverage limits specified by your clients.

- Consider the types of projects you typically work on and the potential liabilities that may arise from these engagements.

- Verify that the insurance policy you select provides coverage for the services you offer and the risks you may encounter.

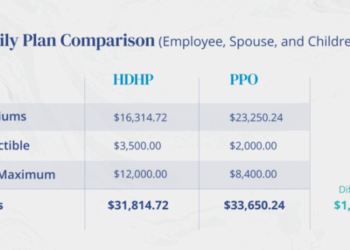

Financial Considerations

- Compare insurance quotes from multiple providers to find a policy that offers comprehensive coverage at a competitive price.

- Evaluate the deductible amount, coverage limits, and premium costs to determine the overall affordability of the insurance policy.

- Consider the potential financial impact of a claim or lawsuit on your business and personal assets.

- Ensure that the insurance policy provides adequate protection against costly legal expenses and damages.

Trends and Changes in Insurance Needs by 2026

In the constantly evolving landscape of insurance, it is crucial for consultants to stay informed about the emerging trends that may impact their insurance needs. Predicting how professional liability and E&O insurance will evolve by 2026 requires a deep understanding of the industry and regulatory changes.

Consultants must prioritize staying updated with insurance policies and regulations to ensure they have adequate coverage for potential risks.

Increased Digitization and Cyber Risks

With the increasing reliance on digital technologies, consultants are facing a higher risk of cyber threats and data breaches. By 2026, the insurance industry is expected to see a rise in demand for cyber liability coverage to protect consultants from financial losses due to cyber attacks.

It is essential for consultants to assess their exposure to cyber risks and consider adding cyber liability insurance to their coverage portfolio to stay protected in the digital age.

Shift in Client Expectations and Specialization

Clients' expectations of consultants are evolving, leading to a shift in the types of services consultants provide. As consultants specialize in niche areas, there will be a growing need for tailored insurance solutions that address the specific risks associated with specialized services.

By 2026, consultants may need to explore customized insurance policies that align with their unique expertise to ensure comprehensive coverage for their professional liabilities.

Regulatory Changes and Compliance Requirements

The regulatory landscape governing insurance policies is constantly changing, impacting the coverage options available to consultants. By 2026, consultants may face new compliance requirements that necessitate updates to their insurance policies. Staying abreast of regulatory changes and understanding how these updates affect insurance coverage is crucial for consultants to maintain adequate protection against potential liabilities.

Last Recap

In conclusion, grasping the intricacies of Professional Liability vs. Errors & Omissions (E&O) Insurance for Consultants — What You Need in 2026 is vital for safeguarding your practice. By staying informed and choosing the right coverage, consultants can navigate potential risks with confidence in the coming years.

Frequently Asked Questions

What is the purpose of professional liability insurance?

Professional liability insurance protects consultants from legal claims related to their services, such as negligence, errors, or omissions.

How does Errors & Omissions (E&O) insurance differ from professional liability insurance?

E&O insurance specifically covers claims of professional negligence, while professional liability insurance has a broader scope of protection.

What are key factors to consider when choosing between professional liability and E&O insurance?

Consultants should evaluate their specific needs, the nature of their services, and the level of risk they face to determine the most suitable coverage.