With Compare High-Deductible Health Plans (HDHPs) for Small Businesses in California (2026 Premiums, HSA Benefits & Requirements) at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling casual formal language style filled with unexpected twists and insights.

The content of the second paragraph that provides descriptive and clear information about the topic

Overview of High-Deductible Health Plans (HDHPs) for Small Businesses in California

High-Deductible Health Plans (HDHPs) are a type of health insurance plan with lower premiums and higher deductibles compared to traditional health insurance plans. They are particularly relevant to small businesses in California as they offer a cost-effective way to provide health coverage to employees while still allowing them to access essential healthcare services.

Key Features and Benefits of HDHPs for Small Businesses

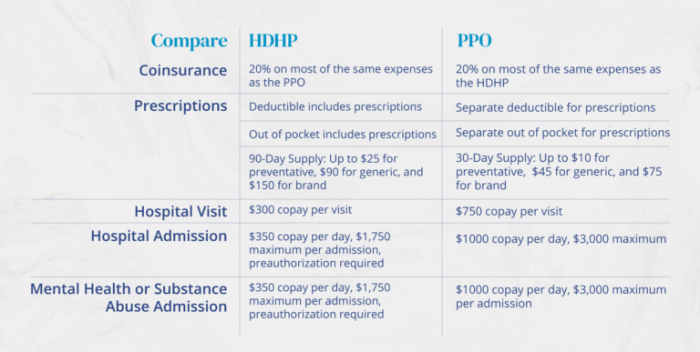

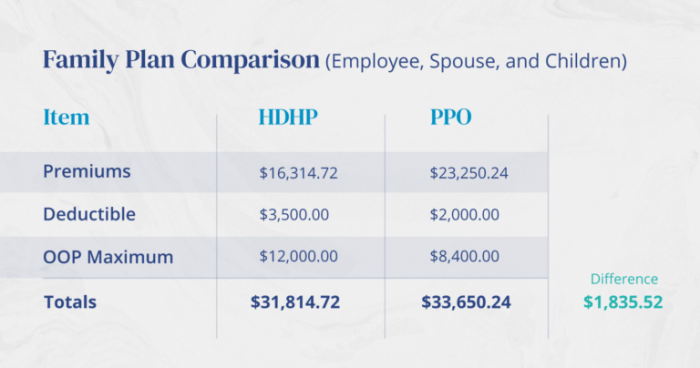

- Lower Premiums: HDHPs typically have lower monthly premiums compared to traditional health insurance plans, which can be advantageous for small businesses looking to manage costs.

- HSA Compatibility: HDHPs are often compatible with Health Savings Accounts (HSAs), allowing employees to contribute pre-tax dollars to cover out-of-pocket medical expenses.

- High Deductibles: HDHPs have higher deductibles than traditional plans, meaning employees are responsible for a greater portion of their healthcare costs before insurance coverage kicks in.

- Preventive Care Coverage: Many HDHPs offer coverage for preventive care services at no cost to employees, helping to promote overall health and wellness.

- Flexibility: HDHPs provide flexibility for employees to choose their healthcare providers and services, giving them more control over their healthcare decisions.

Importance of Considering HDHPs for Small Business Employees in California

- Cost-Effective Option: HDHPs can be a cost-effective option for small businesses looking to provide healthcare benefits to employees without breaking the bank.

- Employee Engagement: Offering HDHPs with HSAs can encourage employee engagement in managing their healthcare expenses and making informed decisions about their health.

- Tax Advantages: Both employers and employees can benefit from tax advantages associated with HDHPs and HSAs, making them an attractive option for small businesses in California.

- Health and Wellness Focus: HDHPs with preventive care coverage can help small business employees prioritize their health and well-being, leading to a more productive workforce.

Comparison of High-Deductible Health Plans (HDHPs) Premiums in California for 2026

In 2026, small businesses in California have a variety of High-Deductible Health Plans (HDHPs) to choose from, each with different premium costs. These premiums play a significant role in the overall affordability and accessibility of healthcare for employees.Premium costs for HDHPs in California for 2026 have shown a slight increase compared to previous years.

This trend may be influenced by factors such as inflation, healthcare costs, and market competition among insurance providers. It is essential for small businesses to carefully compare these premiums to ensure they are offering the best possible coverage for their employees at a reasonable cost.

Comparison of Premium Costs for Different HDHPs

- Plan A: $300 per month

- Plan B: $350 per month

- Plan C: $400 per month

Premium costs can vary based on the level of coverage provided, the network of healthcare providers, and the geographic location of the business. Employers should consider the needs of their employees and weigh the cost of premiums against the benefits offered by each HDHP option

Factors Influencing Variations in Premium Costs

- Level of Coverage: Plans with more comprehensive coverage often have higher premiums.

- Healthcare Providers Network: Plans with a larger network of providers may have higher premiums due to increased access to care.

- Geographic Location: Premium costs can vary based on the cost of healthcare services in different regions of California.

Requirements and Eligibility Criteria for Small Businesses to Offer HDHPs in California

Small businesses in California need to meet specific requirements in order to offer High-Deductible Health Plans (HDHPs) to their employees. These requirements ensure that businesses are compliant with state regulations and provide their employees with access to quality healthcare coverage.

Eligibility Criteria for Small Businesses and Employees

- Small businesses must have fewer than 50 full-time employees to be eligible to offer HDHPs in California.

- Employers must contribute a minimum percentage towards employee premiums to qualify for offering HDHPs.

- Employees must meet certain eligibility criteria set by the employer, such as being a full-time employee or meeting specific tenure requirements.

- Employees enrolling in HDHPs must be eligible for a Health Savings Account (HSA) under IRS guidelines.

Regulations and Compliance Standards

Small businesses offering HDHPs in California should be aware of the following regulations and compliance standards:

- Compliance with the Affordable Care Act (ACA) guidelines for minimum essential coverage and affordability.

- Adherence to state-specific regulations regarding healthcare coverage and employee benefits.

- Ensuring that HDHPs meet the minimum deductible and out-of-pocket limits as defined by federal and state laws.

- Providing employees with clear and transparent information about HDHPs, including costs, coverage, and benefits.

Last Word

The content of the concluding paragraph that provides a summary and last thoughts in an engaging manner

Frequently Asked Questions

Question?

Answer

Continue this structure for all FAQs