Exploring the realm of Small Business Cybersecurity: How to Get Cyber Liability Insurance Quotes Under $50/Month (Coverage Limits & Requirements) opens up a world of possibilities. The journey ahead is filled with valuable insights and practical tips to navigate the complex landscape of cyber insurance.

Delve into the details of cyber threats, coverage limits, and cost factors as we uncover the essentials of safeguarding your small business in the digital age.

Understanding Cyber Liability Insurance

Cyber liability insurance is a crucial safeguard for small businesses in the digital age, providing financial protection against cyber threats and data breaches.

What Cyber Liability Insurance Covers

- First and third-party coverage for financial losses due to data breaches

- Legal fees and expenses associated with cyber liability lawsuits

- Costs of notifying customers about a data breach

- Reputation management and PR expenses after a cyber incident

Examples of Cyber Threats Covered

- Ransomware attacks that encrypt essential files and demand payment for decryption

- Phishing scams that trick employees into revealing sensitive information

- Data breaches resulting from hacking or malware infections

Importance of Cyber Liability Insurance for Small Businesses

Small businesses are increasingly becoming targets for cyber attacks due to their valuable data and often limited cybersecurity measures. Cyber liability insurance helps protect these businesses from financial ruin in the event of a cyber incident, ensuring continuity and trust with customers.

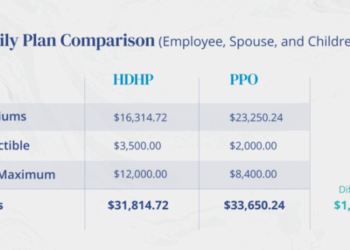

Cost Factors for Cyber Liability Insurance

When it comes to cyber liability insurance, the cost can vary based on several factors. Understanding these factors is crucial for small businesses looking to protect themselves against cyber threats.Coverage limits, industry risk, business size, security measures in place, and claims history are all factors that can influence the cost of cyber liability insurance.

Small businesses may have lower premiums compared to large corporations due to their smaller scale and potentially lower risk profile.

Comparison of Cost for Small Businesses vs. Large Corporations

- Small businesses typically have lower premiums for cyber liability insurance compared to large corporations due to their smaller size and potentially lower risk exposure.

- Large corporations may face higher premiums due to the complexity of their operations, larger amounts of data at risk, and higher likelihood of cyber attacks.

- Small businesses can benefit from tailored policies that fit their specific needs and budget constraints.

Impact of Coverage Limits on Cost

- Coverage limits play a significant role in determining the cost of cyber liability insurance.

- Higher coverage limits will result in higher premiums, as the insurance provider will have to pay out more in case of a cyber incident.

- Small businesses may opt for lower coverage limits to keep premiums affordable, but this could leave them vulnerable to higher out-of-pocket expenses in the event of a cyber attack.

Getting Cyber Liability Insurance Quotes Under $50/Month

When it comes to protecting your small business from cyber threats, obtaining cyber liability insurance is crucial. However, it's also important to find affordable coverage that fits your budget. Here are some tips for getting cyber liability insurance quotes under $50/month:

Tips for Obtaining Affordable Quotes

- Shop around and compare quotes from multiple insurance providers to find the best rate.

- Consider bundling your cyber liability insurance with other business insurance policies to qualify for discounts.

- Implement strong cybersecurity measures and provide evidence of risk management practices to insurers to potentially lower premiums.

- Choose a higher deductible to reduce monthly premium costs.

Strategies for Negotiating Lower Premiums

- Highlight any cybersecurity certifications or training your business has completed to demonstrate proactive risk mitigation.

- Show evidence of regular security assessments and updates to your systems to prove your commitment to data protection.

- Ask your insurance provider about available discounts for implementing specific cybersecurity measures recommended by industry experts.

Discounts and Incentives to Reduce Costs

- Some insurers offer discounts for small businesses that have never experienced a data breach.

- Consider joining industry-specific associations or organizations that offer group discounts on cyber liability insurance.

- Ask your insurance provider about incentives for early payment or loyalty discounts for renewing your policy with them.

Coverage Limits and Requirements

When it comes to cyber liability insurance, understanding the coverage limits and requirements is crucial for small businesses looking to protect themselves from potential cyber threats.

Typical Coverage Limits

Most cyber liability insurance policies offer coverage limits ranging from $1 million to $5 million. These limits determine the maximum amount the insurance company will pay out in the event of a cyber incident.

Basic Requirements for Small Businesses

- Implementing strong cybersecurity measures: Small businesses need to demonstrate that they have proper cybersecurity protocols in place to prevent data breaches.

- Regular security updates: It is essential for small businesses to regularly update their software and systems to protect against vulnerabilities.

- Employee training: Training employees on cybersecurity best practices can help prevent human error that could lead to a data breach.

- Incident response plan: Having a detailed incident response plan in place can help small businesses mitigate the impact of a cyber attack.

Additional Coverage Options

Small businesses should consider additional coverage options beyond the basic requirements to ensure comprehensive protection against cyber threats. Some of these options include:

- Data breach response coverage: This coverage helps cover the costs associated with notifying customers of a data breach and providing credit monitoring services.

- Business interruption coverage: In the event of a cyber attack that disrupts business operations, this coverage can help cover lost revenue and expenses.

- Cyber extortion coverage: This coverage helps protect small businesses from ransomware attacks and extortion attempts by cyber criminals.

Wrap-Up

As we conclude this exploration of Small Business Cybersecurity: How to Get Cyber Liability Insurance Quotes Under $50/Month (Coverage Limits & Requirements), remember that knowledge is your strongest armor in the battle against cyber threats. Stay informed, stay protected, and empower your business for a secure future.

Question & Answer Hub

What are the typical coverage limits for cyber liability insurance policies?

Coverage limits for cyber liability insurance policies can vary widely depending on the insurer and the specific needs of the business. It's essential to carefully review and understand the coverage limits to ensure adequate protection against cyber risks.

What basic requirements do small businesses need to meet to qualify for cyber liability insurance?

Small businesses typically need to demonstrate basic cybersecurity measures such as firewall protection, antivirus software, and employee training to qualify for cyber liability insurance. Insurers may also require businesses to undergo a risk assessment to determine their level of cyber risk exposure.

Are there any additional coverage options that small businesses should consider for cyber liability insurance?

In addition to basic coverage, small businesses may want to explore options such as data breach response coverage, business interruption coverage, and coverage for legal expenses related to cyber incidents. These additional coverages can provide comprehensive protection against a wide range of cyber threats.