Beginning with Avoid Rate Hikes: Get Instant Auto Insurance Quotes Online with No Credit Check in the US (2026 Guide), the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

In today's fast-paced world, getting instant auto insurance quotes online without a credit check has become more essential than ever. Understanding how to avoid rate hikes through timely insurance assessment is crucial for every car owner in the US.

Introduction to Instant Auto Insurance Quotes

When it comes to managing your auto insurance, obtaining instant quotes online can be a game-changer. Instant auto insurance quotes allow you to quickly compare different policies, coverage options, and prices from various insurance providers without the hassle of lengthy phone calls or in-person visits.

Benefits of Getting Quotes Without a Credit Check

One of the significant advantages of getting instant auto insurance quotes online is the ability to do so without a credit check. This means that you can easily access and compare quotes without impacting your credit score, providing a convenient and stress-free way to shop for the best insurance coverage for your needs.

Importance of Avoiding Rate Hikes Through Timely Insurance Assessment

By regularly assessing your insurance coverage and comparing quotes, you can avoid rate hikes that may occur due to changes in your driving record, coverage needs, or other factors. Timely insurance assessment allows you to stay informed about available options and make informed decisions to ensure you are getting the best possible rate without compromising on coverage.

Understanding Auto Insurance Coverage

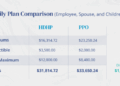

When it comes to auto insurance coverage in the US, there are several different types available to drivers. Two common options are comprehensive coverage and liability coverage, each serving a unique purpose depending on the situation.

Comprehensive Coverage vs. Liability Coverage

Comprehensive coverage provides protection for your vehicle in case of non-collision incidents, such as theft, vandalism, or natural disasters. It covers damages that are not the result of a car accident. On the other hand, liability coverage helps pay for the costs of injuries and property damage that you are legally responsible for in a car accident.

- Comprehensive Coverage Example: If your car is stolen or damaged in a hailstorm, comprehensive coverage would help cover the cost of repairs or replacement.

- Liability Coverage Example: In a scenario where you are at fault in a car accident and the other party's vehicle is damaged, liability coverage would assist in covering their repair costs.

Factors Influencing Auto Insurance Rates

When it comes to determining auto insurance rates, several key factors come into play. These factors can significantly impact how much you pay for coverage. Understanding these influences can help you find ways to lower your insurance premiums.

Driving History

Your driving history is one of the most critical factors that insurance companies consider when calculating your rates. Accidents, traffic violations, and claims on your record can lead to higher premiums. Maintaining a clean driving record by following traffic laws and driving safely can help keep your insurance costs down.

Age

Age is another significant factor that influences auto insurance rates

As you age, maintaining a safe driving record and taking defensive driving courses can help mitigate these increases.

Vehicle Type

The type of vehicle you drive can also impact your insurance rates. High-performance cars, luxury vehicles, and sports cars are generally more expensive to insure due to their higher repair costs and increased likelihood of theft. Opting for a safer, more affordable vehicle can help lower your insurance premiums.

Location

Where you live plays a significant role in determining your auto insurance rates. Urban areas with higher rates of accidents and theft typically have higher premiums compared to rural areas. Additionally, some states have mandatory minimum coverage requirements that can affect your insurance costs.

While you may not be able to change your location, you can explore discounts or incentives offered by insurance companies for specific areas.

Importance of Regular Insurance Reviews

Regularly reviewing your insurance policies is crucial to ensure that you have adequate coverage and are not overpaying for your premiums. It can help you stay informed about any changes in your policy and identify opportunities to save money. Here's why annual insurance reviews are essential:

Avoiding Rate Hikes

Regular insurance reviews can help you avoid unexpected rate hikes by allowing you to identify any potential issues with your coverage or pricing. By staying proactive and reviewing your policy annually, you can catch any discrepancies or errors that could lead to increased premiums.

Here are some tips on what to look for during an insurance policy review:

- Check for any changes in your coverage limits and deductibles to ensure they still meet your needs.

- Review any discounts you may be eligible for and make sure they are applied to your policy.

- Compare quotes from different insurance providers to see if you can get a better deal elsewhere.

- Consider any life changes, such as getting married or buying a new car, that could impact your insurance needs.

- Look for any gaps in coverage that may leave you vulnerable in case of an accident or other unforeseen events.

Conclusive Thoughts

In conclusion, staying informed about auto insurance quotes and avoiding rate hikes can save you money and provide peace of mind. By utilizing the information and tips provided in this guide, you can make informed decisions about your auto insurance coverage.

FAQ Corner

What are the benefits of getting instant auto insurance quotes online?

Getting instant quotes online saves time, allows for easy comparison, and helps in making quick decisions.

How does driving history affect auto insurance rates?

Driving history, including accidents and traffic violations, can significantly impact insurance rates.

Why is it important to review insurance policies annually?

Annual reviews help in ensuring that your coverage is up-to-date and can prevent unexpected rate hikes.