Beginning with Is Your Home Covered? Affordable Flood Insurance Options for Coastal US States (NFIP vs. Private Policies in 2026), the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

Exploring the importance of flood insurance in coastal areas and the options available can help homeowners make informed decisions to protect their homes.

Importance of Flood Insurance in Coastal Areas

Flood insurance is essential for homeowners in coastal regions due to the increased risk of flooding from hurricanes, storm surges, and rising sea levels. Without proper coverage, homeowners could face devastating financial losses in the event of a flood.

Risks Associated with Living in Coastal Areas

- Coastal erosion leading to property damage

- High probability of hurricanes and tropical storms

- Flooding from storm surges and heavy rainfall

Financial Impact of Flood Damage

Homes without flood insurance can incur significant repair costs, loss of personal belongings, and even displacement of residents. The financial burden of rebuilding or repairing a home after a flood can be overwhelming without insurance coverage.

National Flood Insurance Program (NFIP)

The NFIP provides flood insurance to homeowners, renters, and businesses in participating communities. It aims to reduce the financial impact of flooding by offering affordable insurance coverage.

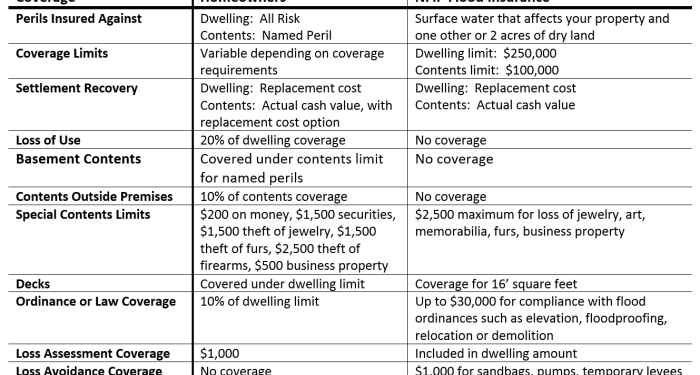

Key Features of NFIP

- Mandatory for properties in high-risk flood zones

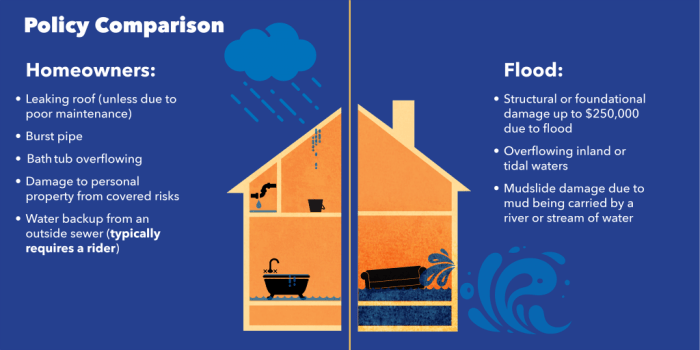

- Provides coverage for building structure and contents

- Offers limited coverage for basements and below-ground areas

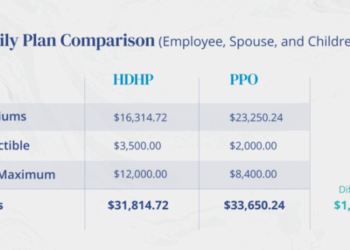

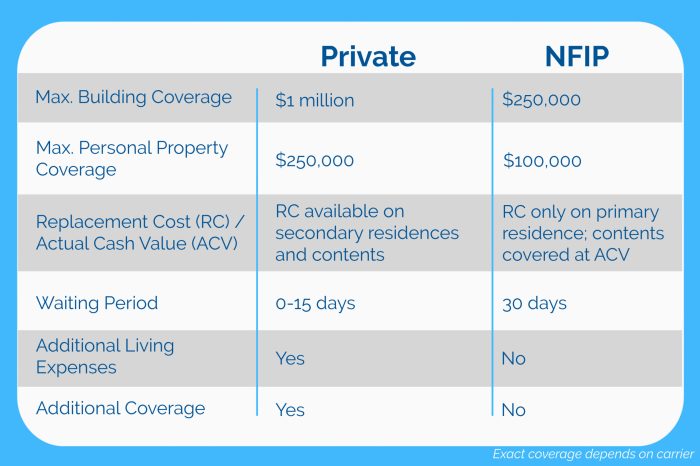

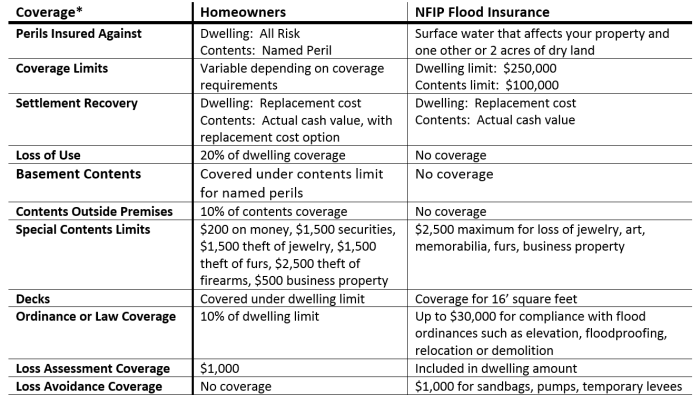

Comparison with Private Insurance Policies

NFIP policies may have lower premiums but offer limited coverage compared to private insurance policies. Private policies often provide more comprehensive coverage options tailored to individual needs.

Eligibility Requirements for NFIP

- Property must be located in a participating NFIP community

- Homeowners must comply with building codes and floodplain management regulations

Private Flood Insurance Options

Several private insurance providers offer flood insurance coverage in coastal US states, providing homeowners with alternative options to the NFIP.

Advantages and Disadvantages of Private Policies

- Advantages: Customizable coverage options, potentially lower premiums

- Disadvantages: Higher premiums for comprehensive coverage, limited availability in some areas

Customized Coverage Options

Private policies may offer additional coverage for items not typically covered by NFIP, such as landscaping, temporary living expenses, and replacement cost coverage for personal belongings.

Changes in Flood Insurance Policies by 2026

Anticipated changes in flood insurance policies by 2026 may include adjustments in premiums, coverage limits, and eligibility requirements, impacting affordability and coverage for homeowners in coastal areas.

Impact on Homeowners

- Increased premiums may make insurance less affordable for some homeowners

- Changes in coverage limits could affect the level of protection against flood damage

Recommendations for Homeowners

Homeowners should stay informed about changes in flood insurance policies, consider alternative insurance options, and take proactive measures to protect their properties against potential flood risks.

Ultimate Conclusion

In conclusion, understanding the differences between NFIP and private insurance policies, as well as being aware of potential changes in flood insurance policies by 2026, is crucial for coastal homeowners to secure adequate coverage and financial protection. Stay informed and prepared to safeguard your home against the unpredictable forces of nature.

User Queries

Is flood insurance mandatory for coastal homeowners?

While it may not be mandatory, it is highly recommended due to the increased risk of flooding in coastal areas.

Can private flood insurance offer better coverage than NFIP?

Private policies may offer more tailored coverage options, but they can also be more expensive. It's essential to compare both options.

What are some eligibility requirements for NFIP enrollment?

Homeowners must live in a participating community and meet certain criteria to be eligible for NFIP coverage.