Beginning with Commercial Auto Insurance in Texas: Compare Rates for Fleets of 5+ Vehicles (2026 Costs, Coverage & Requirements), the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As we delve deeper, we will explore the significance of commercial auto insurance for fleets of 5+ vehicles in Texas, shedding light on the key factors influencing insurance rates and the various coverage options available.

Overview of Commercial Auto Insurance in Texas

Commercial auto insurance is essential for fleets of 5+ vehicles in Texas to protect businesses from financial losses due to accidents, theft, or other damages. It provides coverage for property damage, bodily injury, and legal expenses that may arise from operating commercial vehicles.

Key Factors Impacting Commercial Auto Insurance Rates in Texas

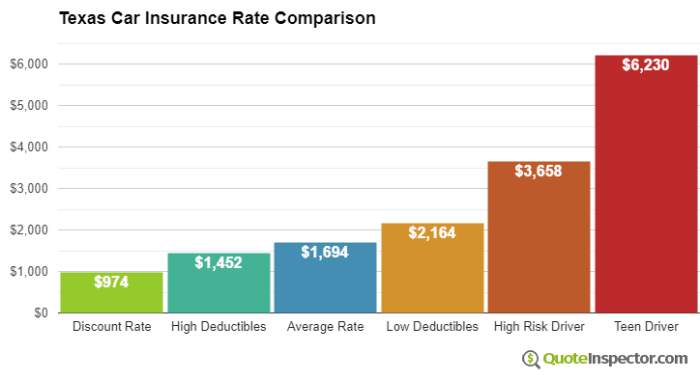

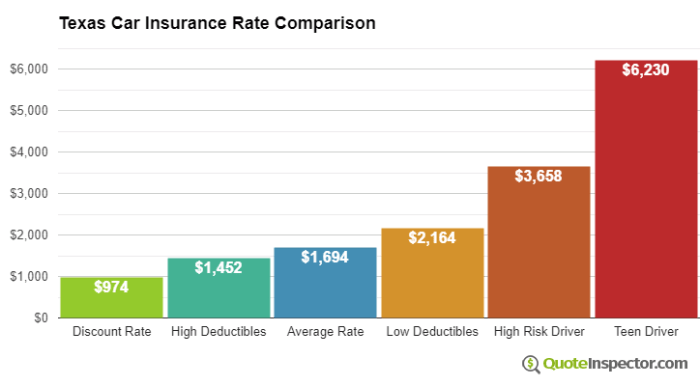

- Driving Record: The driving history of your fleet drivers can significantly impact insurance rates. A clean record can lead to lower premiums.

- Type of Vehicles: The make, model, and age of the vehicles in your fleet can affect insurance costs. Newer vehicles with advanced safety features may qualify for discounts.

- Coverage Limits: The amount of coverage you choose for your fleet vehicles will impact the cost of insurance. Higher coverage limits typically result in higher premiums.

- Location: The area where your fleet operates can also influence insurance rates. Urban areas with higher traffic congestion may have higher premiums.

Common Types of Coverage Offered for Fleet Vehicles in Texas

- Liability Coverage: Protects your business from financial losses if your fleet vehicles cause property damage or injuries to others in an accident.

- Collision Coverage: Covers the cost of repairing or replacing your fleet vehicles if they are damaged in a collision, regardless of fault.

- Comprehensive Coverage: Provides protection for non-collision incidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: Helps cover costs if your fleet is involved in an accident with a driver who lacks insurance or sufficient coverage.

Cost Factors for Commercial Auto Insurance in Texas

When it comes to commercial auto insurance in Texas, there are several factors that can impact the cost of coverage. Understanding these cost factors can help fleet owners make informed decisions when selecting insurance policies.The number of vehicles in a fleet is a key factor that affects insurance costs.

Generally, the larger the fleet, the higher the insurance premiums. This is because more vehicles mean a higher likelihood of accidents or claims, leading to increased risk for the insurance provider.Additionally, the type of vehicles in a fleet can also impact insurance rates.

Vehicles that are more expensive to repair or replace, such as commercial trucks or luxury vehicles, may result in higher premiums due to the increased cost of coverage.

Average Annual Costs of Commercial Auto Insurance for Different Fleet Sizes

- In Texas, a fleet of 5 vehicles can expect to pay an average of $5,000 to $10,000 per year for commercial auto insurance.

- For fleets of 10 vehicles, the average annual cost ranges from $10,000 to $20,000.

- Large fleets of 20 vehicles or more could see annual premiums of $20,000 or more, depending on the specific details of the fleet and coverage needs.

Coverage Options for Fleets in Texas

When it comes to insuring fleets of commercial vehicles in Texas, there are specific coverage requirements that must be met to comply with state regulations. In addition to mandatory coverage, fleet owners have the option to enhance their insurance with additional coverage to protect their vehicles, drivers, and business operations.

Mandatory Coverage Requirements for Commercial Vehicles in Texas

In Texas, commercial vehicles are required to have the following minimum coverage:

- Bodily Injury Liability Coverage: This coverage helps pay for the medical expenses of other drivers, passengers, or pedestrians in an accident where the insured driver is at fault.

- Property Damage Liability Coverage: This coverage helps pay for damages to another person's property caused by the insured driver.

Additional Coverage Options for Fleets of 5+ Vehicles

For fleet owners with 5 or more vehicles, additional coverage options may include:

- Comprehensive Coverage: This coverage helps pay for damages to the insured vehicles caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Collision Coverage: This coverage helps pay for damages to the insured vehicles in case of a collision with another vehicle or object.

- Uninsured/Underinsured Motorist Coverage: This coverage helps pay for damages and medical expenses if the insured vehicle is involved in an accident with a driver who has insufficient insurance coverage.

Benefits of Comprehensive Coverage versus Liability-Only Coverage for Fleet Vehicles

- Comprehensive Coverage provides broader protection for fleet vehicles, covering a wider range of risks beyond just accidents.

- Liability-Only Coverage may be more cost-effective for fleet owners but may leave them vulnerable to financial losses in case of non-collision related incidents.

- Choosing between the two options depends on the specific needs and risk tolerance of the fleet owner.

Requirements and Regulations for Commercial Auto Insurance in Texas

Commercial auto insurance in Texas is subject to specific requirements and regulations set by the state to ensure that fleet owners have adequate coverage in case of accidents or incidents involving their vehicles. It is important for fleet owners to understand these requirements to avoid penalties and ensure compliance with the law.

Minimum Insurance Requirements in Texas

- All commercial vehicles in Texas are required to have a minimum liability insurance coverage of $30,000 per injured person, up to a total of $60,000 for all injured parties, and $25,000 for property damage.

- Additionally, commercial vehicles weighing over 26,000 pounds are required to have a minimum liability coverage of $500,000.

Specific Regulations for Fleet Owners in Texas

- Fleet owners in Texas must ensure that all their vehicles are properly insured at all times and that the insurance coverage meets the state's minimum requirements.

- It is important for fleet owners to provide accurate information about their vehicles and drivers to the insurance company to avoid any discrepancies or issues in case of a claim.

- Fleet owners are also required to notify the Texas Department of Motor Vehicles (DMV) in case of any changes to their insurance coverage or if a vehicle is added or removed from the fleet.

Ensuring Compliance with Insurance Regulations

- Fleet owners can ensure compliance with insurance regulations in Texas by working closely with their insurance agent or provider to review their coverage regularly and make any necessary updates or adjustments.

- It is recommended for fleet owners to keep detailed records of their insurance policies, including proof of coverage and payments, to provide documentation in case of an audit or inspection by the authorities.

- Regular training and communication with drivers regarding insurance requirements and safety protocols can also help fleet owners maintain compliance with insurance regulations in Texas.

Concluding Remarks

In conclusion, the discussion around Commercial Auto Insurance in Texas: Compare Rates for Fleets of 5+ Vehicles (2026 Costs, Coverage & Requirements) leaves us with a comprehensive understanding of the subject, emphasizing the importance of adequate insurance coverage for fleet owners in Texas.

Expert Answers

What are the mandatory coverage requirements for commercial vehicles in Texas?

Commercial vehicles in Texas are required to have liability insurance with minimum coverage limits. Additional coverage options are available for fleet vehicles, such as comprehensive and collision coverage.

How can fleet owners ensure compliance with insurance regulations in Texas?

Fleet owners can ensure compliance by regularly reviewing their insurance policies, maintaining accurate records of their fleet vehicles, and staying informed about any changes in insurance regulations in Texas.