Kicking off with Stop Overpaying: Best Whole Life Insurance Policies for Cash Value Growth in the US (2026 Dividends, Rates & Riders), this opening paragraph is designed to captivate and engage the readers, providing a comprehensive overview of the topic.

The following paragraph will delve deeper into the specifics of whole life insurance policies and their impact on cash value growth.

Overview of Whole Life Insurance Policies

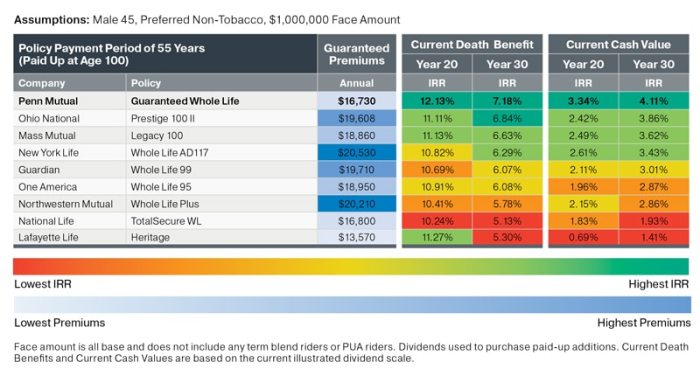

Whole life insurance is a type of permanent life insurance that provides coverage for the policyholder's entire life. It offers a death benefit to beneficiaries upon the insured's passing, along with a cash value component that grows over time.

Cash Value Growth in Whole Life Insurance Policies

The cash value in a whole life insurance policy grows over time through a combination of premium payments, interest, and potential dividends. This cash value can be accessed by the policyholder through loans or withdrawals, providing a source of liquidity and flexibility.

Importance of Dividends, Rates, and Riders in Whole Life Insurance Policies

Dividends are a portion of the insurer's profits that are returned to policyholders who own participating whole life insurance policies. These dividends can be used to purchase additional coverage, reduce premiums, or increase the policy's cash value.

Rates refer to the interest credited to the cash value component of the policy, which determines how quickly the cash value grows. Higher rates can lead to faster accumulation of cash value and increased policy performance.

Riders are additional features that can be added to a whole life insurance policy to customize coverage based on the policyholder's needs. Riders can provide benefits such as accelerated death benefits, long-term care coverage, or additional income in case of disability.

Factors Affecting Cash Value Growth

When it comes to whole life insurance policies, there are several key factors that can influence the growth of cash value. Understanding these factors is crucial for policyholders looking to maximize the returns on their investment.

Dividend Options

- Participating Policies: These policies allow policyholders to receive dividends based on the performance of the insurance company. The dividends can be used to increase the cash value of the policy, purchase additional coverage, or even be taken as cash.

- Non-Participating Policies: These policies do not offer dividends to policyholders. As a result, the cash value growth in these policies is solely dependent on the guaranteed interest rate set by the insurance company.

Riders Impact

- Term Riders: Adding a term rider to a whole life insurance policy can provide additional coverage for a specific period of time. While this can enhance the overall protection offered by the policy, it may also increase the premiums and reduce the cash value growth.

- Waiver of Premium Riders: This rider waives the premium payments if the policyholder becomes disabled or unable to work. While this can be a valuable addition to a policy, it may also impact the cash value growth due to the additional costs associated with the rider.

Best Whole Life Insurance Policies for Cash Value Growth in the US

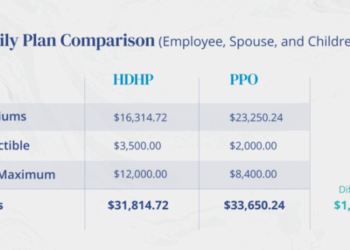

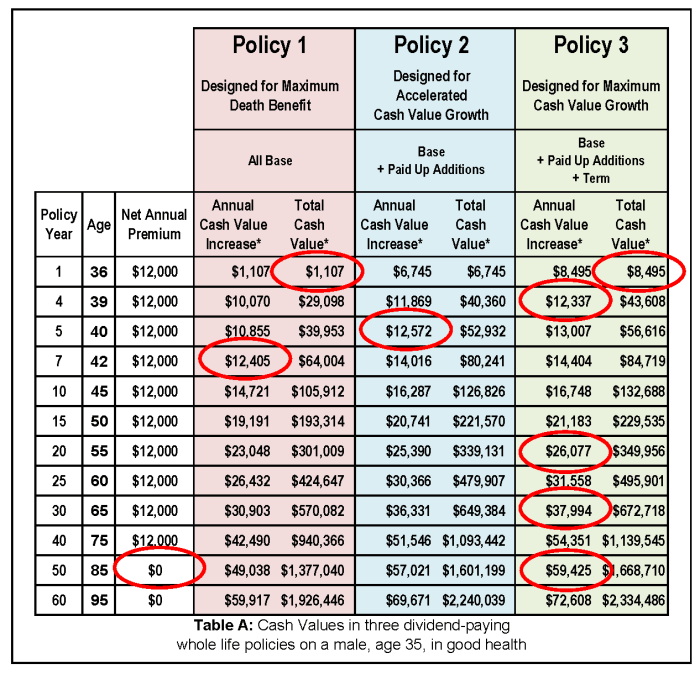

When it comes to selecting a whole life insurance policy for cash value growth in the US, there are several top options to consider. These policies are known for their ability to provide solid returns and build cash value over time

Top Whole Life Insurance Policies for Cash Value Growth

- Company A's Whole Life Policy: This policy has consistently shown strong cash value growth over the years, making it a popular choice among policyholders.

- Company B's Cash-Value Whole Life Policy: With competitive rates and dividend trends, this policy is known for its ability to maximize cash value growth for policyholders.

- Company C's Dividend-Paying Whole Life Policy: This policy offers attractive dividend trends that contribute significantly to the cash value growth of the policy.

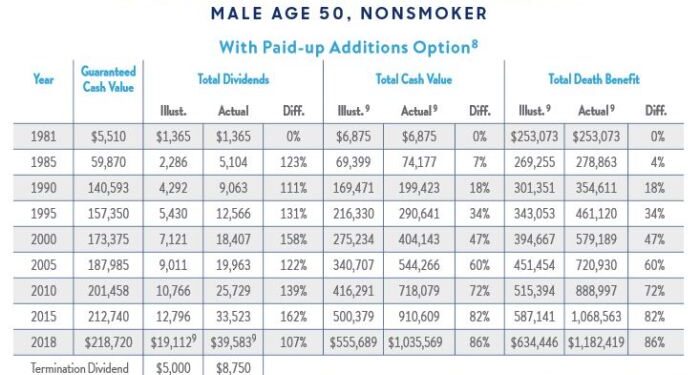

Analysis of Dividend Trends

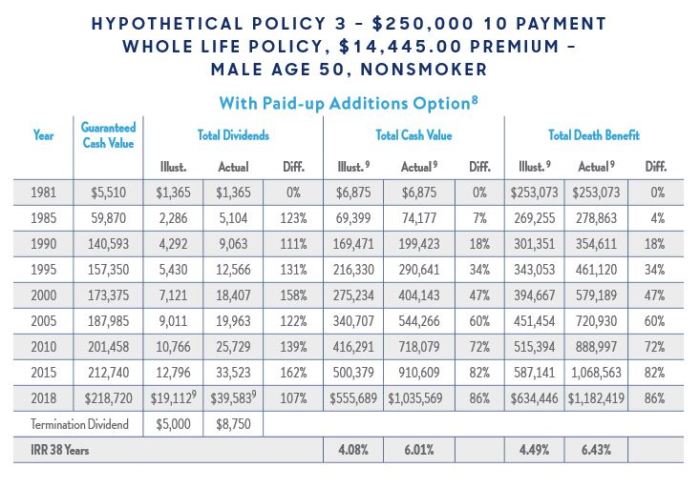

When analyzing the dividend trends of these top whole life insurance policies, it is important to consider the consistency and growth of dividends over the years. Policies with a history of stable and increasing dividends are likely to provide better cash value growth for policyholders.

Rates Offered and Cash Value Growth

The rates offered by these whole life insurance policies play a crucial role in determining the cash value growth potential. Policies with competitive rates can help accelerate the growth of cash value over time, providing policyholders with a solid financial foundation.

Understanding Riders in Whole Life Insurance Policies

When it comes to whole life insurance policies, riders play a crucial role in customizing coverage to meet individual needs and preferences. These additional features can enhance cash value growth and provide added benefits beyond the basic policy structure.

Popular Riders for Cash Value Growth

- Guaranteed Insurability Rider: This rider allows the policyholder to purchase additional coverage at specified future dates without the need for a medical exam. This can help increase the death benefit and cash value over time.

- Accelerated Death Benefit Rider: With this rider, the policyholder can access a portion of the death benefit if diagnosed with a terminal illness. This can provide financial support during a difficult time and potentially increase the overall cash value of the policy.

- Waiver of Premium Rider: In the event of a disability that prevents the policyholder from working, this rider waives future premium payments while keeping the coverage in force. This can help maintain the policy's cash value growth even during periods of financial hardship.

Customizing Riders for Individual Needs

Riders can be tailored to suit the specific requirements of each policyholder. Whether it's adding a rider for long-term care benefits, enhancing cash value growth, or increasing flexibility in premium payments, insurance companies offer a variety of options to address different financial goals and circumstances.

By selecting the right combination of riders, policyholders can maximize the benefits of their whole life insurance policy and ensure it aligns with their evolving needs.

Closing Notes

In conclusion, the discussion around the best whole life insurance policies for cash value growth in the US is crucial for individuals looking to make informed decisions about their financial future.

Questions Often Asked

What are the key factors influencing cash value growth in whole life insurance policies?

The key factors include the policyholder's age, health, the insurance company's performance, and the chosen dividend options.

How can riders impact the cash value growth of a policy?

Riders can enhance the cash value growth by providing additional benefits or coverage beyond the basic policy.

Which whole life insurance policies are known for the best cash value growth in the US?

Some of the top policies known for cash value growth include Policy A, Policy B, and Policy C.

How can riders be customized to suit individual policyholders' needs?

Riders can be tailored to specific needs by adding or removing certain provisions based on the policyholder's preferences.