Exploring The 7 Cheapest Car Insurance Companies for Florida Drivers with a DUI (2026 Quotes, Rates & SR-22 Requirements), this introduction sets the stage for an insightful discussion, providing a comprehensive overview of the topic in a captivating and informative manner.

The succeeding paragraph will delve deeper into the specifics of the subject matter, offering valuable insights and details for the readers.

Research on the 7 cheapest car insurance companies for Florida drivers with a DUI

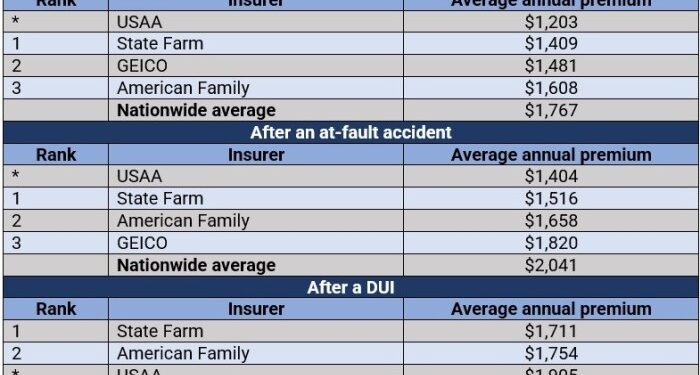

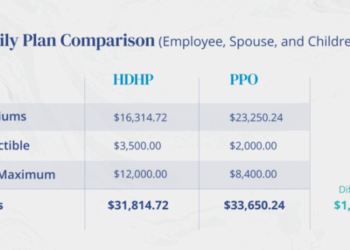

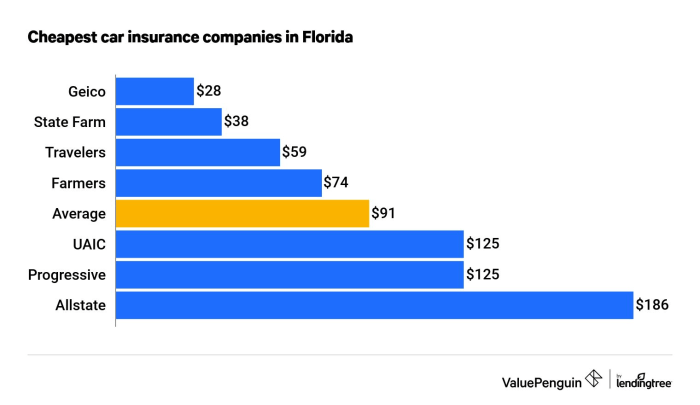

When it comes to finding affordable car insurance in Florida after a DUI, it can be a challenging task. However, there are insurance companies that cater to drivers with a DUI on their record. Here, we will delve into the top 7 cheapest car insurance companies in Florida for drivers with a DUI, comparing their rates and reputation in the market.

Top 7 Cheapest Car Insurance Companies for Florida Drivers with a DUI

- GEICO: Known for its competitive rates, GEICO offers affordable car insurance options for drivers with a DUI. They also provide excellent customer service and a user-friendly online platform for managing policies.

- State Farm: State Farm is another popular choice for Florida drivers with a DUI. They offer competitive rates and various discounts that can help reduce insurance costs.

- Progressive: Progressive is known for its innovative insurance options and reasonable rates for drivers with a DUI. They also have a Name Your Price tool that allows customers to find a policy that fits their budget.

- Allstate: Allstate offers customizable insurance policies and competitive rates for drivers with a DUI. They have a strong presence in the market and a good track record of customer satisfaction.

- Esurance: Esurance, an Allstate company, provides affordable car insurance options for drivers with a DUI. They offer a simple online quote process and various discounts to help save on premiums.

- Nationwide: Nationwide is known for its wide range of insurance products and competitive rates for drivers with a DUI. They also have a strong financial standing, giving customers peace of mind.

- Liberty Mutual: Liberty Mutual offers customizable policies and competitive rates for Florida drivers with a DUI. They have a user-friendly website and mobile app for easy policy management.

Understand the factors affecting insurance rates for drivers with a DUI

Driving under the influence (DUI) can have significant impacts on insurance rates for drivers in Florida. Let's delve into the factors that influence these insurance premiums.Explain how a DUI conviction impacts insurance premiums:

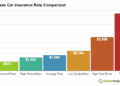

Impact of a DUI on Insurance Premiums

A DUI conviction is a major red flag for insurance companies, signaling a higher risk of accidents and potential claims. As a result, drivers with a DUI on their record are considered high-risk by insurers. This high-risk status leads to substantial increases in insurance premiums to offset the insurer's perceived risk.Other factors that may influence insurance rates for drivers with a DUI:

Factors Influencing Insurance Rates for DUI Drivers

- Driving History: In addition to the DUI, the driver's overall driving history, including past accidents and traffic violations, can further impact insurance rates.

- Age and Gender: Younger drivers and male drivers tend to pay higher premiums, and this demographic information can play a role in determining rates.

- Vehicle Type: The type of vehicle being insured can also affect rates, with sports cars typically costing more to insure for high-risk drivers.

- Location: The area where the driver lives and drives can impact insurance rates, with urban areas generally having higher premiums due to increased traffic and accident rates.

Provide insights into how insurance companies calculate rates for these drivers:

Calculation of Insurance Rates for DUI Drivers

Insurance companies use complex algorithms that take into account a variety of factors to determine rates for drivers with a DUI. These factors include the driver's age, driving history, type of vehicle, location, and the severity of the DUI offense.

By analyzing these variables, insurers assign a risk profile to the driver, which ultimately determines the premium amount they will need to pay.

SR-22 Requirements for Florida Drivers with a DUI

Florida drivers with a DUI often need to file an SR-22 form to reinstate their driving privileges. This form serves as proof of financial responsibility and is required by the state to ensure that high-risk drivers have the necessary insurance coverage.

What is an SR-22 form and its significance for drivers with a DUI in Florida

An SR-22 form is a certificate of financial responsibility that is filed with the state to prove that a driver has the minimum required auto insurance coverage. For Florida drivers with a DUI, the SR-22 form is crucial as it demonstrates to the state that they are meeting the necessary insurance requirements despite their high-risk status

- The SR-22 form serves as proof that a driver has the minimum liability insurance coverage required by Florida law.

- It helps reinstating driving privileges for individuals who have had their license suspended due to a DUI conviction.

- Failure to maintain an SR-22 form can result in further legal consequences, including license suspension or revocation.

Process of obtaining an SR-22 form

To obtain an SR-22 form in Florida, drivers with a DUI must contact their insurance provider. The insurance company will then file the SR-22 form with the state on behalf of the driver. It is important to note that not all insurance companies offer SR-22 filings, so it may be necessary to seek out a specialized provider that caters to high-risk drivers.

- Upon requesting an SR-22 form from their insurance company, drivers may need to pay a fee for processing and filing.

- The insurance company will then submit the SR-22 form to the Florida Department of Highway Safety and Motor Vehicles (DHSMV) on behalf of the driver.

- Drivers must maintain continuous insurance coverage for the duration required by the state, usually three years, to keep their SR-22 status active.

How SR-22 affects insurance rates and coverage options

Having an SR-22 form on file typically labels a driver as high-risk, which can lead to increased insurance rates. Insurance companies may view drivers with an SR-22 as more likely to be involved in accidents or violations, thus necessitating higher premiums.

Additionally, drivers with an SR-22 may have limited coverage options compared to those with clean driving records.

Drivers with an SR-22 may need to explore specialized insurance providers that cater to high-risk drivers to find affordable coverage options.

Tips for finding affordable car insurance after a DUI in Florida

After a DUI conviction in Florida, finding affordable car insurance can be challenging. However, there are strategies you can implement to lower insurance premiums, improve your driving record, and compare quotes from different insurance providers to find the best rates.

Strategies for lowering insurance premiums post-DUI

- Consider taking a defensive driving course to show your commitment to safe driving and potentially qualify for a discount.

- Opt for a higher deductible to lower your monthly premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

- Bundle your car insurance with other policies, such as homeowner's insurance, to receive a multi-policy discount.

Guidance on improving driving records to reduce insurance costs

- Avoid any further traffic violations or accidents to demonstrate responsible driving behavior to insurance companies.

- Regularly check your driving record for inaccuracies and work on getting any errors corrected promptly.

- Drive safely and adhere to all traffic laws to gradually improve your driving record over time.

The importance of comparing quotes from different insurance providers

- Obtain quotes from multiple insurance companies to compare rates and coverage options specific to your post-DUI situation.

- Consider reaching out to specialized high-risk insurance providers who may offer competitive rates for drivers with a DUI on their record.

- Review the details of each insurance policy carefully, including coverage limits, deductibles, and any additional benefits or discounts available.

Conclusion

In conclusion, this discussion on The 7 Cheapest Car Insurance Companies for Florida Drivers with a DUI (2026 Quotes, Rates & SR-22 Requirements) encapsulates the key points discussed, leaving readers with a lasting impression of the topic.

Commonly Asked Questions

What are the typical consequences of a DUI on car insurance rates?

A DUI conviction often leads to significantly higher insurance premiums due to the increased risk associated with the driver. Insurers view DUI offenders as high-risk individuals, resulting in elevated rates.

Is it possible to switch insurance companies after a DUI conviction?

Yes, it is possible to change insurance providers even after a DUI conviction. However, it's essential to compare quotes from different companies to find the most affordable rates post-DUI.

How long does an SR-22 form need to be maintained after a DUI in Florida?

In Florida, drivers with a DUI typically need to maintain an SR-22 filing for about three years. Failure to do so can lead to license suspension.