Delving into The Best Renters Insurance Riders for Luxury Apartments in NYC (Valuables, Liability & 2026 Coverage Rules), this introduction immerses readers in a unique and compelling narrative, with casual formal language style that is both engaging and thought-provoking from the very first sentence.

As we explore the intricacies of renters insurance riders for luxury apartments in NYC, we uncover a world of coverage options and regulations tailored to protect valuable assets and ensure peace of mind for tenants.

Types of Renters Insurance Riders for Luxury Apartments

When it comes to renters insurance for luxury apartments in NYC, there are specific riders that can provide additional coverage beyond the standard policy. These riders are optional add-ons that can be tailored to meet the unique needs of tenants living in upscale residences.

Valuables Rider

One of the most common riders for luxury apartment renters insurance is the valuables rider. This rider provides increased coverage limits for high-value items such as jewelry, art, and electronics. Standard renters insurance policies have limits on how much they will pay out for these items, so a valuables rider is essential for those with expensive belongings.

Liability Rider

Another important rider for luxury apartment renters insurance is the liability rider. This provides additional coverage for legal fees and medical expenses in the event that someone is injured on the property. With luxury apartments often hosting gatherings and events, having extra liability coverage can offer peace of mind.

2026 Coverage Rules Rider

In NYC, there are specific rules and regulations that govern renters insurance coverage, especially for luxury apartments. A 2026 Coverage Rules rider ensures that your policy complies with all local laws and requirements, giving you comprehensive protection tailored to the city's unique regulations.

Valuables Coverage Options

When it comes to renters insurance riders for luxury apartments in NYC, having coverage for valuables such as jewelry, art, or collectibles is crucial to protect your investments. These high-value items may not be fully covered under a standard renters insurance policy, making additional riders necessary.

Coverage Options for Valuable Items

- Riders for jewelry: This type of coverage can protect your valuable jewelry pieces, including engagement rings, watches, and other precious gems.

- Riders for art: If you own expensive artwork or antiques, adding a rider specifically for art can ensure that you are adequately covered in case of damage or theft.

- Riders for collectibles: Whether you collect rare coins, vintage wine, or sports memorabilia, having a rider for collectibles can provide the necessary coverage for these valuable items.

Examples of High-Value Items Covered

- An antique diamond necklace passed down through generations.

- A valuable painting by a renowned artist hanging in your living room.

- A collection of rare coins or stamps carefully curated over the years.

Appraising Valuable Items for Insurance Purposes

When insuring high-value items, it's essential to have them appraised by a professional to determine their current market value. This appraisal will ensure that you have the right amount of coverage in case of loss or damage.

Additionally, keeping detailed records, including receipts, photographs, and certificates of authenticity, can further support your insurance claims and streamline the claims process in the event of a loss.

Liability Coverage for Luxury Apartments

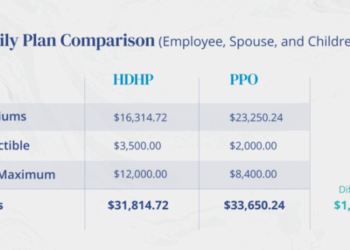

Liability coverage is a crucial component of renters insurance, especially for those living in luxury apartments in NYC. This coverage provides financial protection in case you are found responsible for causing injury to someone else or damaging their property.

Common Liability Risks in Luxury Apartments

- Accidental damage to the apartment structure or common areas.

- Injuries to guests or visitors while on your rented property.

- Water damage from leaks or flooding affecting neighboring units.

How Liability Coverage Works

Liability coverage typically works in conjunction with the standard renters insurance policy. If a liability claim is filed against you, your insurance provider will cover legal fees, medical expenses, and settlements up to the policy's limits. This coverage ensures that you are protected financially in case of unforeseen accidents or incidents.

2026 Coverage Rules and Regulations for Renters Insurance in NYC

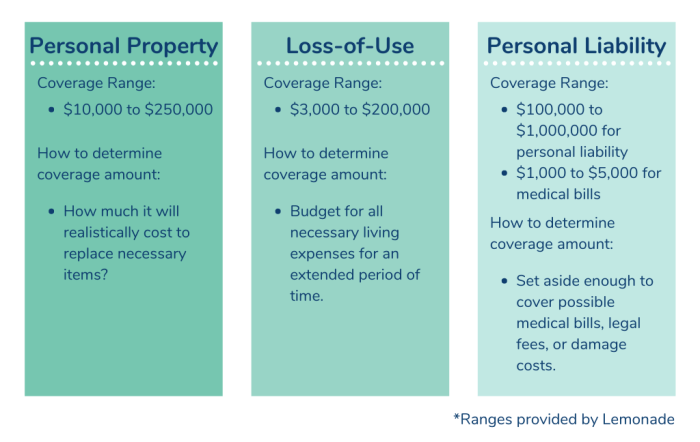

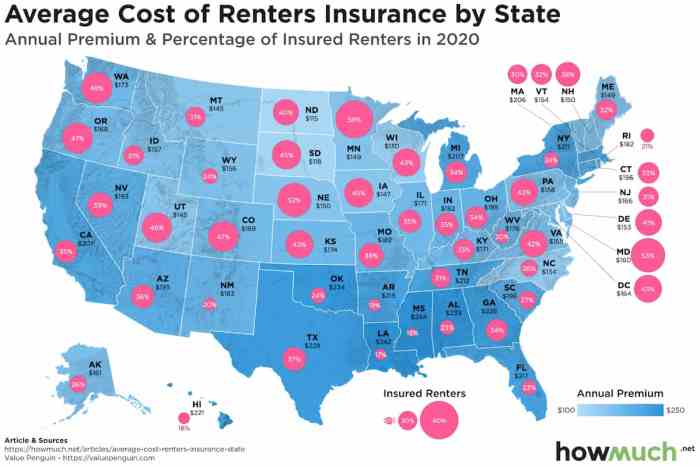

When it comes to renters insurance in New York City, there are specific rules and regulations that govern the coverage options available to tenants. Understanding these guidelines is crucial for residents, especially those living in luxury apartments, to ensure they have adequate protection for their belongings and liability.

Changes and Trends in Renters Insurance Coverage for 2026

As we look towards 2026, there may be upcoming changes or trends in renters insurance coverage in NYC. Insurance companies might start offering more tailored policies to meet the unique needs of luxury apartment renters, such as higher coverage limits for valuables and additional liability protection.

Impact on Renters in Luxury Apartments

These rules and regulations could have a significant impact on renters in luxury apartments. With potential changes in coverage options, tenants may have the opportunity to secure better protection for their high-value items and assets. However, it's essential for renters to stay informed about these developments to make informed decisions about their insurance coverage.

Final Summary

In conclusion, navigating the realm of renters insurance riders for luxury apartments in NYC demands careful consideration of valuables, liability, and coverage rules. By understanding the nuances of these policies, tenants can safeguard their possessions and mitigate risks effectively.

FAQ Resource

What is the process of appraising valuable items for insurance purposes?

The appraisal process typically involves assessing the value of items through a professional appraisal or using receipts, photographs, and other documentation to prove value. Insurers may require specific appraisal methods for high-value items.

How does liability coverage work in conjunction with standard renters insurance?

Liability coverage in renters insurance typically covers legal expenses, medical bills, and damages resulting from accidents or injuries on the property. It complements standard coverage by offering additional protection beyond personal property coverage.

Are there any upcoming changes or trends in renters insurance coverage for 2026?

While specific changes may vary, trends in renters insurance for 2026 may include enhanced digital services, customized coverage options, and potential adjustments in premium rates based on risk factors. It's essential for tenants to stay informed about any evolving regulations.